Bitcoin vs. Gold: Which is the Better Investment?

Bitcoin and gold are often compared as alternative assets, with both being considered stores of value, inflation hedges, and safe-haven investments. However, they differ significantly in their history, volatility, use cases, and risks. Below is a comparison of the key factors to determine which may be the better investment.

Store of Value & Longevity

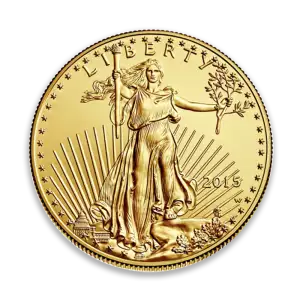

- Gold: Has been used as a store of value for thousands of years and has consistently held purchasing power over time.

- Bitcoin: A much newer asset, created in 2009. While it has gained adoption, its long-term reliability as a store of value is still being tested.

- Winner: Gold – Proven history of stability and wealth preservation.

Inflation Hedge

- Gold: Historically maintains purchasing power during inflationary periods. However, in some short-term cases, gold has not reacted as expected to inflation.

- Bitcoin: Considered “digital gold” by some, but its effectiveness as an inflation hedge is debated due to high volatility and price corrections during inflationary periods (e.g., 2021-2022).

- Winner: Gold – More established as an inflation hedge.

Volatility & Risk

- Gold: Generally stable with slow price appreciation over time.

- Bitcoin: Highly volatile, with price swings of 50%+ in a short time, making it riskier for conservative investors.

- Winner: Gold – Less volatility and lower investment risk.

Scarcity & Supply Limits

- Gold: Naturally scarce, with a limited and slow-growing supply due to mining. However, new gold deposits could still be discovered.

- Bitcoin: Hard-capped at 21 million coins, ensuring absolute scarcity. This makes Bitcoin theoretically more deflationary than gold.

- Winner: Bitcoin – Fixed supply and no risk of additional issuance.

Adoption & Use Cases

- Gold: Used in jewelry, industry, and as central bank reserves.

- Bitcoin: Digital currency that can be used for transactions, remittances, and decentralized finance, but faces regulatory and adoption challenges.

- Winner: Gold – Broader use cases beyond investment.

Liquidity & Market Size

- Gold: A $12+ trillion market with deep liquidity worldwide.

- Bitcoin: Around $1 trillion in market capitalization, but growing in liquidity over time.

- Winner: Gold – More liquid and widely accepted.

Portability & Ease of Transfer

- Gold: Heavy and difficult to transport in large amounts.

- Bitcoin: Instantly transferable worldwide with no physical constraints.

- Winner: Bitcoin – Superior portability and accessibility.

Security & Counterparty Risk

- Gold: Cannot be hacked but requires physical security (vaults, safes, or third-party storage).

- Bitcoin: Can be stored securely with self-custody, but is vulnerable to hacks, scams, and lost access if private keys are misplaced.

- Winner: Gold – No digital security risks.

Government Regulation & Seizure Risk

- Gold: Can be confiscated by governments (e.g., U.S. Gold Confiscation in 1933). Governments can also manipulate gold prices through central bank reserves.

- Bitcoin: Governments may regulate Bitcoin, but decentralized networks make seizure and control more difficult. However, regulations on exchanges could limit access.

- Winner: Bitcoin – Harder for governments to control.

Returns & Growth Potential

- Gold: Steady, low-to-moderate appreciation. Historically, it has provided stable returns, but not high-growth potential.

- Bitcoin: High-growth potential with massive past returns but also extreme corrections and high risk.

- Winner: Bitcoin – Higher return potential but with greater risk.

Final Verdict: Which is Better?

The better investment depends on investment goals and risk tolerance:

Gold is better for conservative investors who want a stable, time-tested store of value with low risk.

Bitcoin is better for risk-tolerant investors who want high-growth potential and are willing to accept volatility and regulatory uncertainty.

Best Strategy?

A diversified approach—owning both gold and Bitcoin—can provide the benefits of stability and potential high returns, balancing risk and reward.