Why Invest in Precious Metals

Investing in precious metals such as gold, silver, platinum, and palladium offers a range of benefits that make them a strong asset class for both individual and institutional investors. Below are key arguments supporting the case for investing in precious metals:

Hedge Against Inflation

- Precious metals, particularly gold and silver, have historically maintained their value over time.

- As fiat currencies lose purchasing power due to inflation, the price of precious metals tends to rise, making them an effective hedge.

Safe-Haven Asset in Economic Uncertainty

- During financial crises, economic downturns, or geopolitical instability, investors flock to precious metals for stability.

- Unlike stocks and bonds, which can lose value during recessions, precious metals often appreciate when markets are uncertain.

Protection Against Currency Devaluation

- Government policies such as money printing (quantitative easing) can lead to currency devaluation.

- Gold and silver retain value regardless of fluctuations in fiat currency values, providing a safeguard against devaluation.

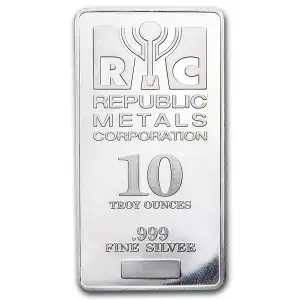

Tangible and Intrinsic Value

- Unlike stocks or cryptocurrencies, precious metals are physical assets that can be held in hand.

- They are universally recognized and have intrinsic value due to their use in industry, jewelry, and technology.

Diversification for Investment Portfolios

- Adding precious metals to an investment portfolio reduces overall risk by diversifying assets.

- Since precious metals often move inversely to stocks and bonds, they help stabilize returns during market volatility.

Increasing Industrial Demand

- Silver, platinum, and palladium are essential in electronics, automotive (EV batteries and catalytic converters), and renewable energy industries.

- As demand for technology and green energy rises, so does the long-term value of these metals.

Limited Supply and Scarcity

- Precious metals are finite resources, and mining operations face increasing challenges and costs.

- The supply constraints, combined with growing demand, drive up the long-term value of these assets.

No Counterparty Risk

- Unlike stocks, bonds, and digital assets, which depend on third parties (companies, governments, or financial institutions), precious metals are not reliant on any issuer or institution.

- Investors physically own their assets, reducing exposure to systemic financial risks.

Universal Store of Value

- Precious metals have been used as money for thousands of years, proving their long-term reliability.

- They are accepted globally, making them a universally recognized asset.

Wealth Preservation for Generations

- Gold and silver have been passed down for centuries as a means of preserving wealth.

- Unlike paper currency, which can become obsolete, precious metals remain valuable across generations.

Liquidity and Marketability

- Precious metals can easily be bought, sold, or traded in global markets.

- Gold and silver, in particular, have highly liquid markets with strong demand.

Protection from Political and Banking System Failures

- Precious metals provide security in cases of government instability, capital controls, or banking system failures.

- Countries facing hyperinflation or banking collapses (e.g., Venezuela, Zimbabwe) have seen precious metals hold value while national currencies plummeted.

Conclusion

Investing in precious metals offers financial security, portfolio diversification, and protection against inflation, economic downturns, and currency devaluation. Whether as a hedge against risk or as a long-term store of wealth, precious metals remain a fundamental and strategic asset in any investment portfolio.